Understanding California's Natural Hazard Disclosures: A Guide for Home Buyers, Sellers, and Real Estate Professionals

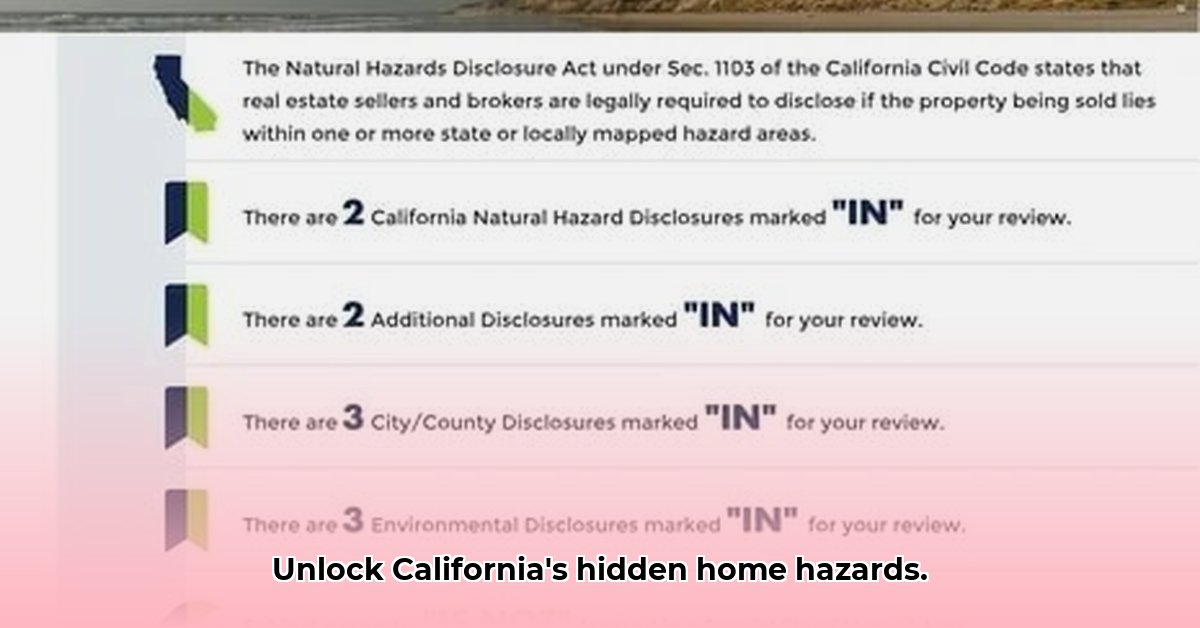

Buying or selling a home in California involves navigating the state's natural hazard disclosure laws. These disclosures, often referred to as "Snap Natural Hazard Disclosures," are legally mandated reports detailing potential risks to a property from natural events like wildfires, floods, and earthquakes. Understanding these reports is crucial for making informed decisions and avoiding costly surprises. This guide provides a step-by-step approach to interpreting these disclosures for all stakeholders.

Decoding the Snap Natural Hazard Disclosure: Key Elements and Their Significance

California's Snap Natural Hazard Disclosure is a legally required document outlining potential natural hazards affecting a property. This detailed risk assessment informs buyers and sellers about potential issues like wildfires, floods, earthquakes, and landslides. The report significantly impacts a property's value, insurance premiums, and sale price.

The reports often use sophisticated computer models to predict risks, providing a more precise picture but potentially overwhelming users with data. This guide focuses on interpreting and acting on the essential information. Understanding the terminology is critical; for example, AB38 refers to California legislation focusing on wildfire mitigation strategies.

A Step-by-Step Guide to Interpreting Natural Hazard Disclosures

Don't just skim the report; understanding its contents fully is crucial. Follow these steps:

Step 1: Thorough Review. Carefully read the entire report, paying close attention to each identified hazard and its associated risk level. Don't hesitate to reread sections that are unclear.

Step 2: Seek Expert Assistance (When Necessary). Complex reports might require professional interpretation. A qualified geologist, structural engineer, or other relevant expert can help clarify uncertainties and offer actionable advice, especially for properties with high-risk designations. This is particularly important for high-value properties or those with complex hazard profiles.

Step 3: Explore Mitigation Strategies. The report highlights potential hazards; determine if mitigation steps can reduce risks. Examples include creating defensible space (clearing brush around a home to prevent wildfire spread), improving drainage to reduce flood risk, or implementing seismic retrofits for earthquake protection. These improvements can increase property value and reduce insurance premiums. Understanding AB38's fire-hardening requirements is essential.

Step 4: Consider Insurance Implications. Natural hazard disclosures directly impact insurance premiums and coverage availability. Understanding the potential increase in premiums due to identified risks helps in budget planning and negotiation.

Step 5: Use Updated Data Sources. Hazard zone designations are regularly updated. Ensure that your report uses the most recent data from official sources, such as FEMA flood maps and the California Department of Forestry and Fire Protection (CAL FIRE) wildfire hazard maps.

Impact on Buyers, Sellers, and Real Estate Professionals

The Snap Natural Hazard Disclosure has significant implications for all parties involved in a real estate transaction:

Sellers: Proactive hazard mitigation increases your property's value and attractiveness to buyers. Demonstrating responsible homeownership by addressing identified risks builds trust and confidence.

Buyers: Carefully review the report to make informed decisions and negotiate a fair price that reflects the disclosed risks. Incorporate potential mitigation costs into your offer if necessary.

Real Estate Agents: Stay updated on regulations and assessment technologies to effectively guide clients. Your expertise can help navigate complex disclosures and facilitate informed transactions.

Long-Term Planning and Ongoing Risk Management

In California's dynamic environment, long-term planning for natural hazards is essential. Continuously monitor risks and update mitigation strategies as needed. Regularly review insurance coverage to reflect current risk assessments, and stay informed about changes in regulations and disclosure requirements. This proactive approach protects your investment and minimizes potential future problems.

Sample Risk Assessment Matrix (Illustrative Example)

(Note: This is a simplified example. Actual risk levels depend on specific location and property characteristics. Consult professional assessments for accurate risk evaluation.)

| Hazard | Likelihood (General) | Impact (General) | Mitigation Strategy Examples |

|---|---|---|---|

| Wildfire (AB38) | High | High | Defensible space, fire-resistant materials, vegetation management |

| Flooding | Medium to High | Medium to High | Improved drainage, elevated foundation, flood barriers |

| Earthquake | Low to Medium | High | Seismic retrofits, structural improvements |

| Landslide | Low to Medium | Medium to High | Land stabilization, drainage improvements |

"Understanding and addressing these risks is crucial for responsible homeownership in California," says Dr. Emily Carter, Professor of Geology at Stanford University. "Proactive mitigation not only protects your property but also enhances its long-term value."

Key Takeaways:

- California law mandates comprehensive natural hazard disclosures.

- Understanding the report impacts property value, insurance, and sale price.

- Proactive mitigation reduces risk and improves property value.

- Professional guidance is recommended for complex situations.

This guide provides a framework for understanding California's natural hazard disclosures which are critical for informed decision-making in real estate transactions. Always consult with professionals when needed, especially for complex or high-risk situations.